Untangling Staking Rewards and Validator Choices in Solana’s Wild West

Okay, so check this out—staking on Solana isn’t just about parking your tokens and watching rewards trickle in. Nope. It’s more like navigating a buzzing farmers market where every vendor promises the freshest produce, but you gotta know which stall is legit. Initially, I thought staking was a set-it-and-forget-it deal. But man, the deeper I dove into validator selection and portfolio tracking, the more I realized this ecosystem demands some real attention to detail.

Whoa! When I first started playing with staking rewards, I was all about maximizing percentages, blindly chasing the highest APYs. Something felt off about just picking the shiniest numbers, though. Validators aren’t created equal, and my gut said there’s more under the hood than just numbers flashing on my screen. Plus, with DeFi apps and staking interfaces evolving fast, keeping tabs on your portfolio gets tricky.

Here’s the thing. Solana’s network relies heavily on validators — those nodes that confirm transactions and keep things humming. If you stake your tokens with a sketchy validator, you risk losing rewards or worse, slashing penalties. But the catch is, there’s a ton of validators out there, and picking the right one isn’t always straightforward. Some have stellar uptime and community trust, others maybe not so much. And because Solana’s ecosystem moves at lightning speed, a validator’s status can shift quick. So, yeah, it’s a bit like dating — some folks look good on paper but don’t show up when it counts.

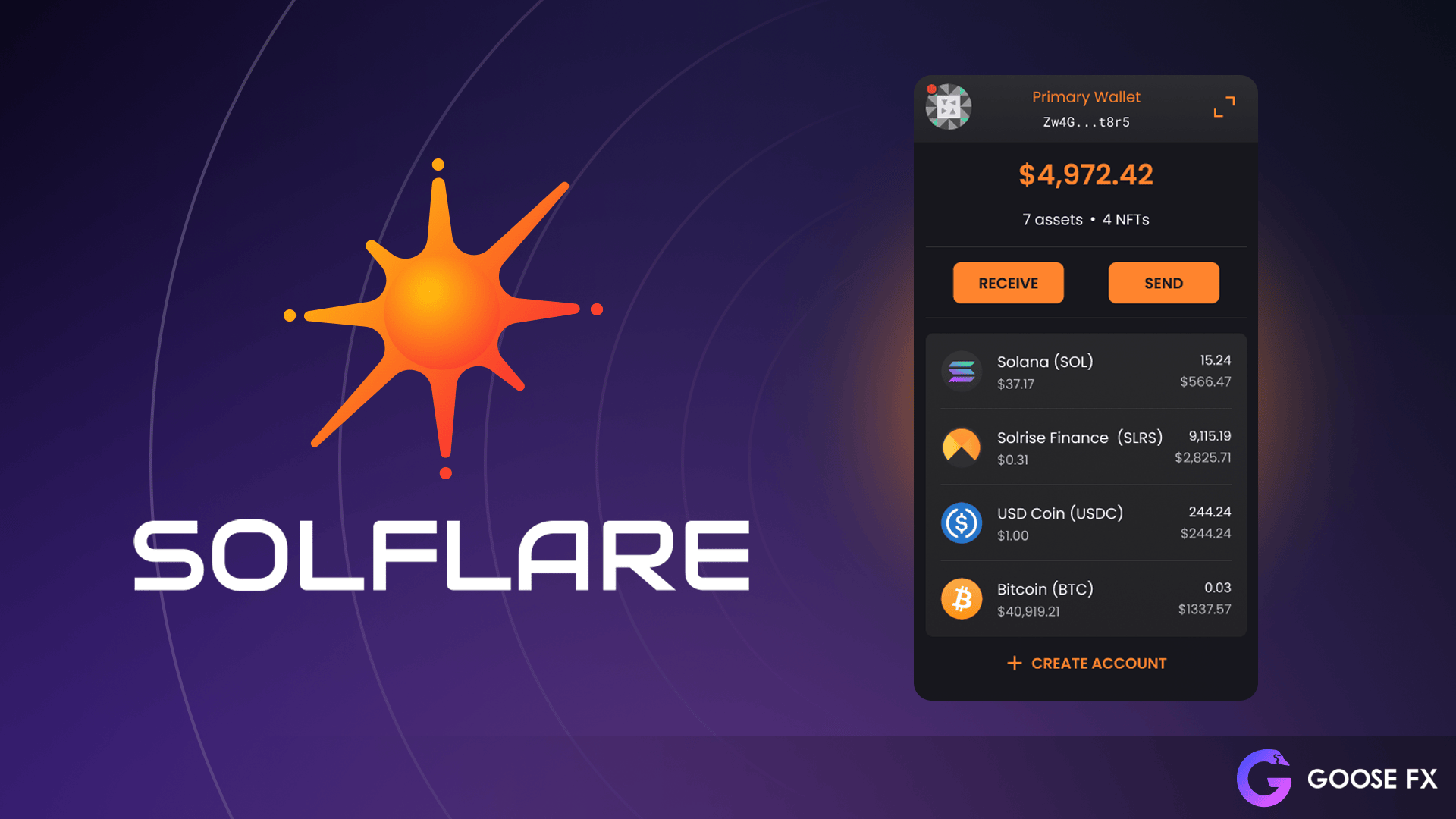

Now, I’m biased, but I found solflare to be a game-changer here. It’s not just a wallet; it’s like having a personal assistant for your Solana stake. The interface helps you track your portfolio in real time, compare validator fees, performance, and even warns of potential risks. Honestly, without it, I’d be lost trying to juggle all these moving parts.

Really? Yeah, it surprised me how many folks overlook portfolio tracking tools in their staking journey. You’d think it’s obvious, but I caught myself forgetting to check rewards or validator health regularly. And that’s dangerous because just like stock portfolios, crypto stakes fluctuate—and so do reward rates.

So, here’s a wild thought: why don’t more people treat staking like active portfolio management rather than passive income? I get that many want passive gains, but ignoring validator health or network updates is like leaving your car running with the gas tank leaking. Not smart. And this is where a tool like solflare really shines, giving you alerts and a clear snapshot of your staking health.

On the topic of validator selection, it’s a mixed bag. On one hand, you want validators with low fees so you keep more of your rewards. Though actually, sometimes paying slightly higher fees to a reliable validator is worth it because they might slash less often or have better uptime. Initially, I thought the lowest fee was king, but then I realized uptime and reputation matter much more for consistent earnings.

Hmm… and have you noticed how some validators hype themselves up with fancy websites but deliver mediocre performance? That part bugs me. It’s tempting to chase validators with slick marketing, but your rewards depend on their tech and commitment. I’ve seen validators drop offline during network spikes, causing stakers to miss out big time.

By the way, there’s this natural tension between decentralization and staking rewards. If everyone piles into the top few validators, it defeats the purpose of a decentralized network. Yet, many stakers just want to stack rewards and ignore the broader impact. I’m not 100% sure how to balance these competing priorities, but it’s something worth thinking about—especially if you care about Solana’s long-term security.

And, oh! Let me share a quick story. A friend of mine blindly staked with a validator that promised 8% APY. Sweet, right? Except, the validator had frequent downtime and charged high fees, so actual take-home was closer to 4%. Plus, they didn’t warn users about the risk of slashing. He was bummed but learned the hard way why validator research matters. I think stories like this are why tools that combine staking and portfolio tracking in one place are invaluable.

Why Portfolio Tracking Isn’t Just a Nice-to-Have

Tracking your staking rewards in Solana is like keeping an eye on your favorite team’s stats during a season—you want to know who’s performing and who’s slacking. The problem is, rewards come in sporadic chunks, and fees or network issues can eat into your profits slowly but surely. Without regular check-ins, you might miss a validator’s drop in performance or a sudden fee hike.

My instinct says that if you’re serious about staking, ignoring portfolio tracking is just asking for trouble. Sure, it adds a bit of overhead to your routine, but it pays off. I use solflare because it brings everything together—staking, wallets, even DeFi interactions—so I’m not toggling between half a dozen apps. Plus, the visuals help me spot trends and outliers quickly.

Here’s a quick tip: set yourself reminders to review your staking portfolio weekly. Yeah, it sounds like extra work, but crypto moves fast, and so do validator performances. If you’re like me, sometimes you forget till it’s too late.

Something else that’s kinda fascinating is how validator communities play a role. Some validators engage their stakers with transparency and updates, while others go radio silent. That community connection might not directly impact your rewards, but it sure builds trust, which feels important in this space. I’ve learned to favor validators that communicate openly—even if their fees are a tad higher.

So, yeah, staking rewards get complicated quickly. But once you start actively managing your portfolio and picking validators with care, it’s more rewarding (literally and figuratively). It’s like cultivating a garden—you can’t just plant seeds and hope for the best; you gotta pull weeds, water, and watch for pests.

To wrap this thread of thought (though not really wrap, because I’m still pondering…), staking on Solana is a blend of tech savvy, regular check-ins, and a pinch of intuition. Just throwing your tokens into any validator hoping for the best won’t cut it if you want steady, reliable rewards. And with tools like solflare, that complexity gets a bit more manageable.

FAQs About Solana Staking and Validators

How do I choose a good validator on Solana?

Look beyond APY—check uptime, fees, community reputation, and communication. Validators with consistent performance and transparency often yield steadier rewards. Tools like solflare simplify this by providing detailed stats and alerts.

Why is portfolio tracking important for staking?

Because staking rewards and validator health fluctuate over time. Regular tracking helps you spot issues early, adjust your stakes, and avoid losing out on potential earnings due to downtime or slashing.

Can I stake directly from my wallet?

Yes! Many wallets, including solflare, have integrated staking features that let you delegate tokens without jumping through hoops, making the process more user-friendly.